In April of 2017, someone filled out a form on my website requesting Foreclosure Help in Greenville NC. When I called, she told me she saw a sign on the road that said Mike Buys Houses in Greenville NC. After seeing the sign, she did a Google search for “Mike Buys Houses” and found me—what luck!

We began to talk and she started to tell me about her situation…

Situation

She had a beautiful 3 bedroom, 2 bath, single-family ranch home in Greenville NC. It was built in 2004, and the structure and exterior were in good condition. Located 20 minutes from East Carolina University, and convenient to places of employment, and highway access. These are the type of houses that we love to buy!

After speaking with this home-seller, I found out that the mortgage was a few months behind. Mortgage payments had not been made since December of the previous year. This is a situation I can help with so I decided to do some research and then set an appointment to come see the home the next day.

I did research on the South Greenville area and I saw plenty of comparable sales, steady appreciation, as well as ample job opportunities at East Carolina University, Pitt County Memorial Hospital, and Vidant Medical Center (which is a nationally ranked center of medicine).

At Otranto Real Estate Co. we buy houses in good areas of North Carolina that fit these criteria!

A few days later, I drove into Greenville and met with the sellers. I was able to talk to both homeowners and find out more about their situation. The real problem was they could no longer afford to make their mortgage payments and keep up with the expenses of home maintenance.

Problem

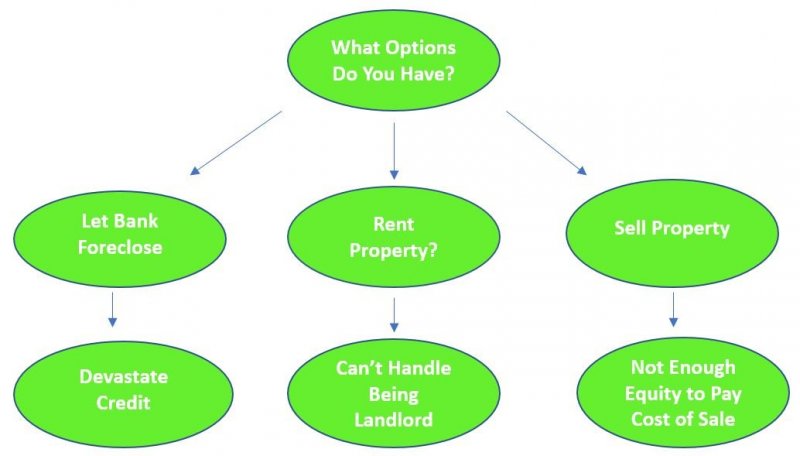

Can no longer afford payment – Let Bank Foreclose?

They stopped making payments in December 2016 and were now five months behind. This led to a series of fees being added to their total balance. This is often referred to as “arrears”, meaning the total amount of accrued payments + fees together.

When I looked at the property to get an estimate of repairs I noticed some heavy wear & tear but nothing major. Still, to get a home ready for sale, and to compete with similar homes in the area, several thousand dollars would have to be spent.

One option they had was to simply move out of the home and let the bank foreclose. This is never the best option due to the devastating effect a foreclosure has on one’s credit.

Devastate Credit?

Their credit score was already being beaten up by the late payments being reported by the mortgage company. The other issue was that this loan servicer seemed like they just wanted to hammer the family with collection calls until they collected their money. This only delayed the process and dragged their credit score lower and lower.

The damage to their credit report would prevent them from renting another house or apartment, and give them problems when trying to get other forms of credit.

There are also tax penalties when letting a home go into Foreclosure. In the event of a deficiency judgment, the seller would have gotten a “1099” from the government requiring them to pay taxes on the money that the bank wrote off as a loss. This would have meant even more money out the window.

Rent property

A great way to handle debt is to get someone else to pay it for you. As a buyer of properties in the Greenville NC area, we’re always buying properties and then renting them out, essentially having someone else pay the debt on our behalf.

In this particular case, there were mortgage arrears that had to be paid, and repairs that needed to be made, before being able to rent the property. It would have cost them about $15,000 to bring the mortgage current, and to get the property in rent-ready/sale-ready condition.

Ready to be a landlord?

As someone with a lot of experience, I can say that being a landlord is not easy, and it’s not for everyone. In this case, renting a property would have added more stress and anxiety to a situation that was already difficult.

Sell property

Many times, if an owner can no longer afford their mortgage payment, they will just put the home on the market and sell the property. However, it costs time, and money to sell a house.

The time it takes to sell a house can be broken down into 2 phases: time to find a buyer, and time for the buyer to obtain financing and close.

Below is a datasheet of housing market statistics for Wake County NC:

As you can see in the above graph, the average time on the market for a seller in Wake County is 37 days. The Triangle MLS website has a wealth of information on local housing trends.

The Greenville housing market is a little different. I had to do some digging to find out what the average time on the market was for that area.

As you can see above, the median days on market in Greenville NC is 80 days. That is not a good number if you must sell a house fast!

Also, this is the time it takes to find a buyer, NOT cash a check. The buyer still must qualify for financing. If you’re behind on your mortgage you may not have enough time to sell your house on the MLS.

Cannot pay cost of sale

They had met with a few agents and there was not enough spread between the amount owed on the mortgage, and the market value of the home to pay the cost of sale.

In order to sell, they would have to pay the following fees:

- Brokerage fees

- Ad Valorem taxes

- Attorney fees

- Document & recording fees

- Mortgage payoff

- Last minute repairs

- Buyer closing costs (paid as concessions)

There was not enough equity in the property to cover all these costs so they would have to come to the closing with a check for several thousand dollars, not something they were able to do.

At this point in the decision-making process, I always like to ask the question, what will happen if we do nothing and just let it go?

The consequences of foreclosure are numerous. In addition to the devastation to your credit report and score, many homeowners forget that there are tax penalties to losing your home to foreclosure. Anytime debt is forgiven, the IRS considers any borrowed money not paid back to be a taxable event, and will enforce tax penalties.

It will become especially difficult to rent another home after a foreclosure. It will also be difficult to buy/lease a car, take out student loans, obtain a credit card or store credit, and even get a job.

Solution

The most viable solution in this type of situation is to avoid foreclosure, or short-sale, and bring the mortgage current by leasing the property.

Unfortunately, most home sellers do not have the resources, to cure their arrears, pay to renovate the home, and bring it to rent-ready condition, but we do, and, we do this very well!

We buy houses that are behind on mortgage payments! In this situation, due to the location of the property, the strength of the local economy, and the fact that the mortgage payment was low enough to support vacancy, repair allowances, and management fees. We were able to cure the arrears on this property, renovate it to rent-ready condition, and find someone from the hospital that needed housing.

This was a true win-win situation for all involved.

If you, or any friends, or family members are behind on their mortgage or struggling to pay the mortgage in Greenville NC, or another area of North Carolina, simply fill out the form below and see if we can help. We buy houses for cash in Greenville. We’re more than happy to review your options with you with no commitment.